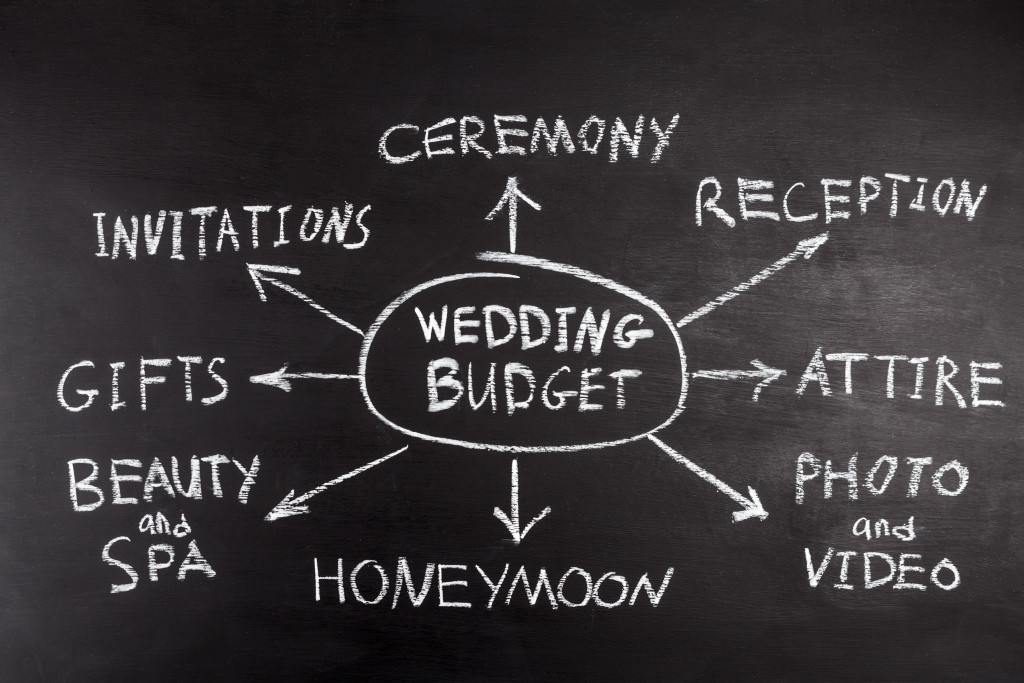

Weddings can be exciting for couples, their families, and their friends. But they can also be a lot of work. When planning a wedding, you’ll need to start by deciding on a budget. You’ll need to choose a venue, pick out invitations, select a catering company, and more. Unfortunately, all that might lead you to think that a wedding is impractical and, most of all, expensive.

A study by The Knot found that the average cost of a wedding in the United States was $34,000. That number might be enough to make you think twice about getting married, especially when you know married life will be even more expensive.

Fortunately, abandoning the idea of a grand wedding doesn’t mean you have to give up on the idea of getting married altogether. A small wedding can still be a beautiful and unique event and cost less money. Also, you have plenty more cash to dedicate to other stuff like these.

Building a Home

A home is a significant investment that will appreciate over time and provide years of enjoyment. A home is also where you and your family can build memories that will last a lifetime.

A wedding, on the other hand, is a one-time event. Even if you spend a lot of money on your wedding, it’s not an investment that will grow in value. You might even lose money if you don’t plan carefully.

Plus, there are plenty of expenses associated with a home that you won’t have to worry about with a wedding. For example, you’ll need to pay mortgage interest, property taxes, homeowners insurance, and maintenance and repairs.

Mortgage loans are necessary to finance the purchase of a home. If you already have enough for your down payment and closing costs, you might not have much money left for a wedding. If you managed to save for those, building and renovating the house might be your next priority. You must invest in tools, home improvement materials, and professional services to get the job done. If you want to do it alone, your investments might be cheaper, requiring only materials and tools instead of hiring professionals. You can find a company that offers excavator rental in the Philippines. The equipment is expensive to purchase, so renting one is better. Also, you won’t be using it again after you’re done fixing your house.

Creating a Joint Emergency Fund

One of the essential things a married couple can do is to have a joint emergency fund. This fund should include enough money to cover at least six months of living expenses in an emergency.

There are many reasons why having a joint emergency fund is essential:

- Knowing that you and your spouse can weather any storm together gives you peace of mind.

- It can help you avoid debt if you face an unexpected significant expense.

- It can help you stay afloat if one spouse loses their job.

The best way to create a joint emergency fund is to start saving for it immediately. Begin by setting aside a small amount of money each month and then gradually increase the amount as your budget allows. You can also contribute extra money to your fund when you receive bonuses or tax refunds.

If you can build a healthy joint emergency fund, you will stay much better prepared for the unexpected challenges of married life over a wedding.

Child’s Health and Education

Concerning a wedding, there are plenty of expenses to consider. Unfortunately, many couples spend too much money on their marriage and don’t have enough left over for other important things like their child’s health and education.

Creating a fund for your child’s health and education is a much wiser investment than spending money on a wedding. A healthy and well-educated child can achieve great things in life. By contrast, a child who isn’t healthy or doesn’t have a good education may struggle throughout life.

It’s essential to start saving for your child’s health and education as early as possible. The sooner you begin, the more money you will have available to contribute. You can make monthly contributions or save up for more significant expenses like college tuition. If possible, you can invest in a 529 savings plan.

A 529 savings plan is an investment account that offers tax advantages to help you save for your child’s future education expenses. It can be used for tuition, room and board, books, and other qualified fees at any accredited college or university.

Final Thoughts

Remember that a wedding is just one day, while a marriage is a lifetime. While weddings are beautiful and special occasions, they can be costly. If you’re on a tight budget, you might want to consider ways to save money on your big day. Or better, invest it in your marriage.