- Understanding personal financial standing, which includes evaluating income, savings, investments, and debts, forms the initial step toward financial security.

- Open communication about financial plans and goals with your partner is critical for financial harmony in marriage.

- Constructing a comprehensive budget helps control spending and promotes effective saving towards set goals.

- An emergency fund equivalent to three to six months’ worth of living expenses is a robust financial safety net to cushion against unforeseen costs.

- Seeking professional advice and considering a prenuptial agreement can clarify financial responsibilities and facilitate informed decision-making.

As a modern bride, it’s about choosing the perfect wedding dress or venue and financially preparing for your future. This guide will explore how to attain financial security before saying, ” From creating a budget to understanding your financial compatibility with your partner, we’ll cover all you need to know to walk down the aisle confidently.

Understand Your Financial Standing

Before making any major financial decisions, it’s critical to understand your financial situation clearly. This means evaluating your income, savings, investments, and debts. Know the exact amount of your monthly income and expenses, such as rent, utilities, groceries, and personal expenses.

Make notes of any debts you may have, including student loans, credit card debts, or car loans. Assess your savings – do you have an emergency fund for unexpected expenses? Are you saving for retirement? Understanding your financial standing is the first step towards financial security. It not only helps you manage your current financial situation, but it also aids in planning for your future after the wedding.

Open Communication

Once you’ve understood your financial standing, the next crucial step involves maintaining open and transparent communication about finances with your partner. Here are some tips:

Set Financial Goals

Setting financial goals as a couple is a pivotal step in ensuring a secure financial future. This could involve short-term objectives such as saving for a honeymoon or buying a new car long-term goals like investing in a home, planning for children’s education, or retirement savings. It’s important to be realistic and specific while setting these goals.

For instance, instead of saying, ” We want to buy a house,” try defining it as ” We want to save $50,000 for a down payment on a house in the next five years” . Having quantifiable goals helps to design financial plans effectively. Everyone’s financial journey is different, so your goals should align with your immediate needs and long-term aspirations.

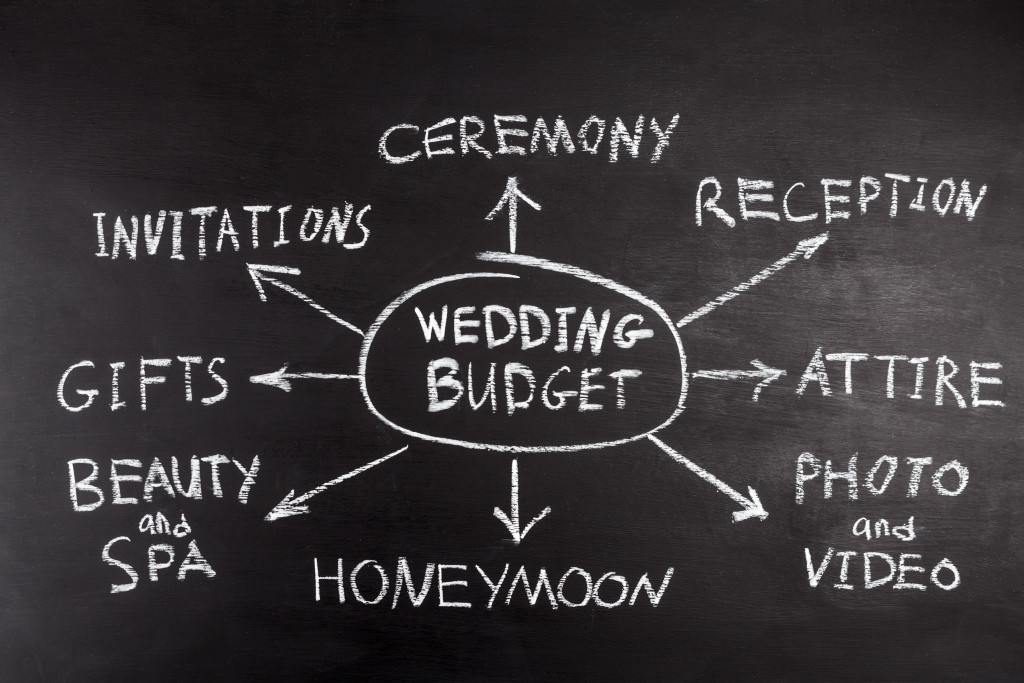

Create a Budget

Creating a comprehensive budget is integral to achieving your financial goals. Start by noting your regular income sources and fixed expenses, including rent/mortgage, utilities, groceries, health insurance, and debts. Then, consider variable expenses such as entertainment, dining out, vacations, and personal care.

Allocate funds for savings and emergency requirements as well. Make sure to revisit and adjust your budget as your circumstances change. This could be due to income increases, expense changes, or a shift in financial goals. Using budgeting apps or software can be a helpful tool in managing your finances effectively. Remember, the goal of budgeting is not to restrict but to give you control over your money, ensure you can save for your future, and provide you with financial security.

Establish an Emergency Fund

Establishing an emergency fund is one of the most important steps toward financial security. An emergency fund is a financial safety net designed to cover unexpected expenses such as medical bills, car repairs, or sudden loss of income. Ideally, it should contain enough money to cover three to six months’ living expenses.

Having an emergency fund provides peace of mind and means you won’t have to rely on credit cards or loans in a crisis, preventing you from falling into debt. Start building your emergency fund by setting aside a portion of your income each month. Even if you can only afford to save a small amount, consistency is key, and over time, it will grow. Remember, it’s never too early or too late to start an emergency fund; it is an essential aspect of financial planning for everyone, engaged or not.

Consider a Prenuptial Agreement

While often misunderstood, a prenuptial agreement is a smart, strategic decision that provides couples with a clear understanding of their financial responsibilities and expectations in a marriage. It’s a legally binding contract entered into by a couple before marriage, outlining the division of assets, liabilities, and financial responsibilities in the event of a divorce.

Despite the misconception, a prenuptial agreement isn’t about anticipating divorce but preparing for all eventualities. It encourages open and honest discussion about finances, ensuring both parties are protected. You can book a free prenup consultation with reputable providers like Wenup for a seamless process.

Wenup offers a collaborative, open, and amicable platform, making the process affordable and easy. With Wenup , both parties are represented, fulfilling the requirement for a couple’s agreement to be legally upheld. This proactive approach helps secure your financial future, giving you peace of mind as you embark on this new journey together.

Seek Professional Advice

For complete financial security, it’s beneficial to seek professional advice. With their expertise and experience, financial advisors can provide valuable insights into creating a robust financial plan tailored to your needs. They can guide you through various financial matters, from investing to retirement planning, and help you navigate potential financial hurdles.

This may include understanding and improving credit scores and tax or estate planning. Moreover, they can provide an unbiased opinion, facilitating open dialogue about finances within your relationship. By seeking professional advice, you ensure your decisions are well-informed, enabling an enriched financial life. While it’s an investment, the long-term benefits of professional financial advice are significant, contributing to a financially secure future as you start your new life together.

In conclusion, taking control of your financial future is essential as you embark on your marital journey. You’ll foster a stable financial foundation by understanding your financial standing, setting goals, budgeting, creating an emergency fund, considering a prenuptial agreement, and seeking professional advice. Start today and embark on the journey to a secure financial future.